Making sense of financial aid and the value of a college education

There is no getting around the fact that college comes with a price tag. However, it’s important to understand that higher education is first and foremost an investment in your future—you receive the value of the education you invest in.

According to Forbes, students who graduate with a bachelor’s degree earn significantly more than peers with only a high school diploma. Despite the rising costs of college tuition, having a degree still pays off; education is an investment in a secure future with higher pay rates and lower unemployment rates.

One important thing to keep in mind when looking at colleges is that the actual cost is not always as high as the tuition price makes it seem. The price you see on the tuition and fees page is often different from the price you’ll end up paying out of pocket. In 2023, 95 percent of Lake Forest College students received some form of financial aid.

So how does that work?

The overall cost of college attendance is offset by federal, state, and institutional funding. At Lake Forest, for example, our scholarship programs are generous and only made possible by the endowment funds of the College. The endowment comes from donors who understand the value of a Lake Forest education—they believe this is worth it, and they are committed to making it as accessible as possible.

Our Forester Flagship Program provides qualified in-state first-year and transfer students with 100 percent of the College’s tuition covered in grants and scholarships.

Determining what kind of education is within reach and what is financially feasible depends on a number of factors. Let’s demystify the world of financial aid to help put a great education within reach.

What is financial aid?

College financial aid helps students and their families by covering higher education expenses such as tuition and fees, room and board, books and other coursework supplies, and transportation.

There are several types of financial aid:

- Grants

- Scholarships

- Federal or private loans

- Work-study and other programs

We’ll get into the intricacies and differences between each kind of aid below. What’s important to understand first is that there are different kinds of aid from different sources that help offset the cost of education.

To fully untangle the confusion surrounding financial aid, Assistant Vice President for Enrollment Mike Cohen recommends filling out the Free Application for Federal Student Aid, or FAFSA. “Filling out the FAFSA will give you a better understanding of the overall cost of education,” Cohen explained. “The more you know and the more you understand, the more you can feel that you have agency in the funding process. This will help you make the best choice for yourself.”

To fully untangle the confusion surrounding financial aid, Assistant Vice President for Enrollment Mike Cohen recommends filling out the Free Application for Federal Student Aid, or FAFSA. “Filling out the FAFSA will give you a better understanding of the overall cost of education,” Cohen explained. “The more you know and the more you understand, the more you can feel that you have agency in the funding process. This will help you make the best choice for yourself.”

Filling out the FAFSA is a great first step in understanding what is and is not feasible at different institutions across the United States.

Often, students receive award and aid packages from universities that outline the combined FAFSA allotments and the institutional awards. This helps determine the actual out-of-pocket cost for the student.

Asking questions and understanding your needs

As a student, there are many factors at play when it comes to choosing a college to attend. For many, cost and financial aid packages are important factors. Althought it’s a common consideration, many students and families find themselves unsure of where to start.

“Too often students wonder ‘can I even ask this question?’” Cohen said. “Here, the answer is always yes. Nobody should feel like they have to figure this out all by themselves.”

Associate Vice President for Financial Aid Jerry Cebrzynski maintains that societal narratives surrounding financial aid can make issues of funding seem more daunting and complicated than they are for many families.

“Many families mistakenly think they won’t qualify for aid simply because of their income when in fact so many other variables come into play such as household expenses or other special circumstances,” Cebrzynski said. “When all is said and done, so many families are pleasantly surprised by the outcomes of their aid packages.”

The Net Price Calculator can help estimate costs on an individual basis, but asking questions about financial aid can always help provide clarity.

“ Don’t let the weight of your concerns sit on your shoulders. The longer you let it sit, the more your anxiety will build. The clarity of getting answers will help you understand the whole picture and make the idea of funding college less intimidating.”

It’s true that the question of financial aid is a big one with a lot of facets, but asking questions can help reduce the confusion that often surrounds funding college. A great place to start for students interested in Lake Forest College is the Financial Aid for New Students page.

For Cohen, the best things students or families can do is ask questions. “Don’t let the weight of your concerns sit on your shoulders. Verbalize it,” Cohen said. “The longer you let it sit, the more your anxiety will build. The clarity of getting answers will help you understand the whole picture and make the idea of funding college less intimidating.”

But who can you ask? College admissions counselors, personal or academic mentors, people on staff and leaders in community organization, and high school counselors are all great resources for questions about aid in general.

Making it achievable with different forms of aid

A college degree does pay off. According to The New York Times, most degrees do pay for themselves in under 10 years, and a bachelor’s degree is more likely to show a return on investment than a two-year degree or certificate.

However, there are more than just loans to help pay for college. “Financial aid is not just student loans; it also includes gift aid like grants and scholarships,” Cebrzynski explained. “Financial aid itself is the umbrella for every type and source of financial aid that helps a student with their costs. Under this umbrella, financial aid is divided between merit-based and need-based aid as well as gift aid like grants and scholarships and self-help like student loans and work-study.”

Lake Forest College was ranked as a best value college in 2024. What does that mean? For its Best Value list, U.S. News & World Report evaluates a school’s academic quality and net cost of attendance for a student who received the average level of need-based financial aid. We are about educational access and attainment, and we strive to make a great education accessible to all academically qualified students.

Ultimately, it is up to individual students or families to determine what is financially feasible for their unique situation. There is no one-size-fits-all for financial aid since funding an education can look vastly different for people.

“If you feel as though your situation is complicated, talk to financial aid and have that conversation sooner rather than later,” Cohen advised. Getting an expert’s perspective on your unique situation can help diminish the confusion surrounding the topic of financial aid.

Here are a few different types of aid and what they mean.

Scholarships

Scholarships are blocks of funding in different amounts that students are not expected to repay. Did someone say “free money”?

Scholarships are often merit-based or won through essay contests, but not exclusively. How awards are distributed is determined by the organization providing the money.

Many civic, corporate, and private organizations offer students awards based on place of residence, background, professional affiliation, academic achievement, or intended field of study. There are thousands of private organizations that offer scholarship awards ranging from $50 to $20,000 and more.

Scholarships come from a variety of sources, including:

Scholarships come from a variety of sources, including:

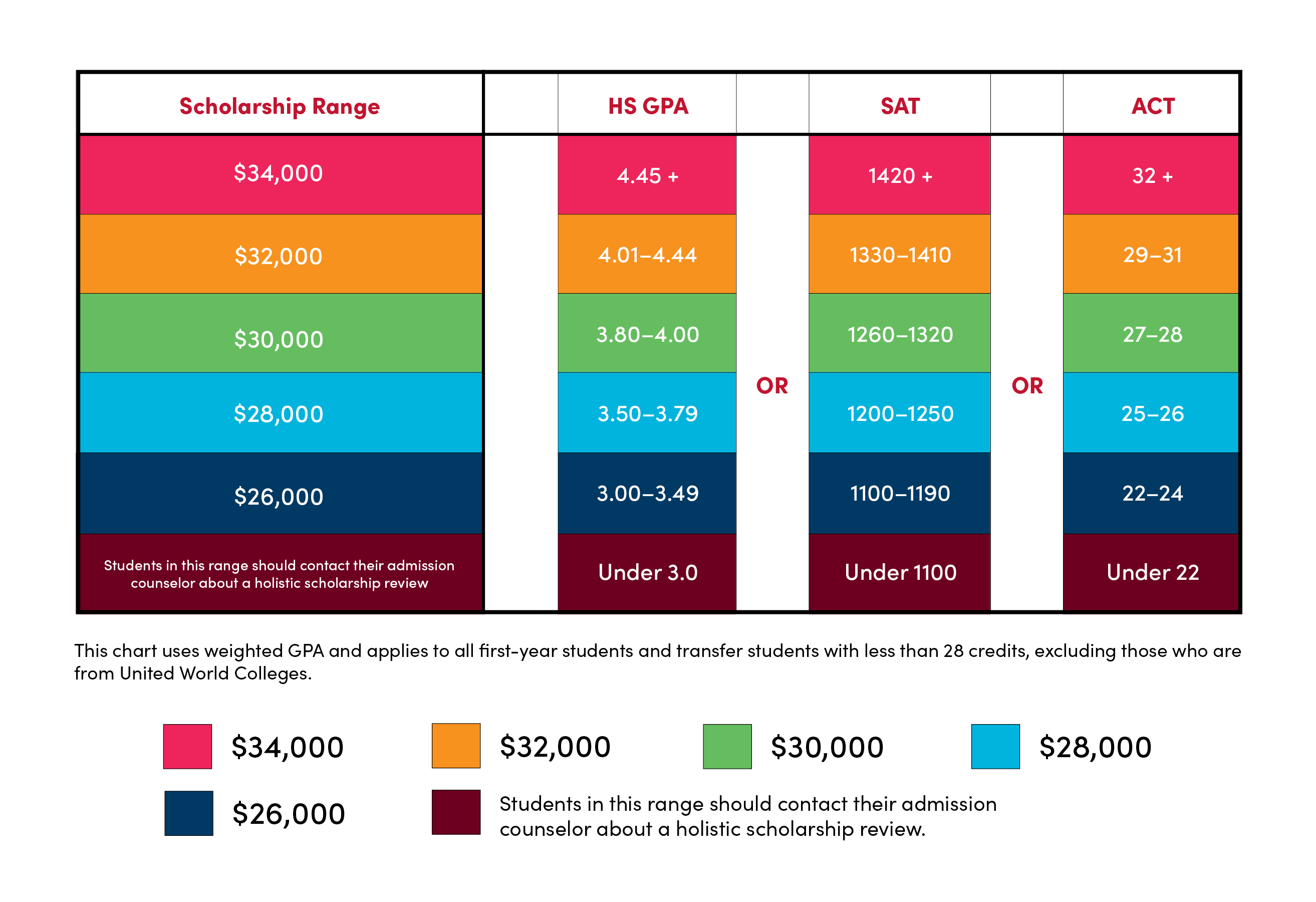

- Higher education institutions as part of an award package

- For example, Lake Forest College automatically offers scholarships to incoming students based on factors like GPA. These scholarships come from the College’s endowment.

- Non-profit foundations

- Corporations

- Community organizations

- And many more

Need-based aid

Need-based aid is often determined by FAFSA. It is based on an individual family's income for the previous year.

- Grants are usually awarded based on “financial need” and do not need to be repaid. Grants come from several sources including the College, some states, and the federal government.

- Loans are forms of funding that must be repaid along with accrued interest. Educational loans are available from a variety of sources, allowing students and/or parents to borrow funds that can pay some or all college costs. While the “best” loans are federal loans based on financial need and require the annual completion of the FAFSA, there are programs for virtually every family, regardless of income. Many loans do not require repayment while the student is enrolled.

- Work-study is a federal program that allows students to earn money while working for the school part-time. Jobs are available in administrative offices, academic departments, the library, the sports center, campus security, and other campus locations.

Financial aid for undocumented students

Undocumented students may not be eligible for all forms of federal financial aid, but there are a variety of sources available. Students who are neither US citizens nor permanent residents may be eligible for funding from the College, the State of Illinois, and private sources.

Financial aid for international students

The College demonstrates its commitment to global diversity by providing significant financial aid to international students. Learn more about financial aid for international students.

Outside organizations

There are plenty of organizations outside the federal and state government or higher education institutions that can provide scholarships and grants to help fund education. These can be based on a variety of factors including academic merit, essays, cultural heritage, place of residence, religion, and more.

Making sense of the numbers: how to read an award letter

Understanding how to read your award letter is crucial to getting the full picture of a financial aid package. At Lake Forest College, we prioritize transparency and try to make the letter as clear as possible; there are no hidden fees or loans disguised as grants. The letter offers a breakdown of estimated costs, financial aid eligibility, estimated payment and payment options, important messages about your financial aid, and next steps.

“A degree is a path towards the completion of countless milestones, achievements, and goals, and planning and understanding financial aid can help reduce the uncertainty surrounding the value of a degree.”

Out-of-pocket costs are what you pay upfront. They do not include loans. Typically, loans will be paid after graduation.

Lake Forest College graduates carry less student loan debt than the average American college graduate. “Our Class of 2021 graduated with approximately $25,000 in federal student loan debt,” Cebrzynski said. “The national average is almost $30,000.” One of the College’s goals is to make the Lake Forest experience attainable for all academically qualified students.

Making decisions

When deciding on where to enroll, it’s important to have all of the information to make an informed decision. That must include a financial aid award letter. It’s recommended to make sure you have all award letters from institutions you applied to before deciding to commit to your institution of choice.

U.S. News & World Report ranked Lake Forest College #1 in the nation as a Top Performer on Social Mobility, reaffirming our commitment to accessible education. The Social Mobility list measures and ranks a college’s success in graduating students from economically disadvantaged backgrounds.

Cohen advises families to understand their financial situations before committing to a school: “Make sure you have a strong sense of what it means to pay for college and how you’re going to pay for it.”

Combining different types of aid, stacking scholarships, and understanding loans will help make those decisions seem less daunting. A degree is a path toward the completion of countless milestones, achievements, and goals, and planning and understanding financial aid can help reduce the uncertainty surrounding the value of a degree.